automotive investment in Saudi Arabia

Automotive investment in Saudi Arabia is still in its early stages. The major winners and losers in this transformation haven’t been fully determined.

The most successful automotive investments in Saudi Arabia recognize the cultural dimension. They approach is recognizing the Kingdom not merely as a market or manufacturing location, but as a transformative partnership that will reshape their entire business.

Table of Contents

✅ Listen to this PODCAST EPISODE here:

The Digital Integration

For companies willing to approach the Kingdom with the right mindset and strategy, the opportunity isn’t just to participate in this revolution – it’s to help define it.

Want to know the most overlooked aspect of automotive investment in Saudi Arabia? It’s not the manufacturing. It’s not even the vehicles themselves.

It’s the digital ecosystem being built around transportation – an ecosystem that will redefine how vehicles are sold, operated, maintained, and monetized.

This fundamental perspective shift explains why automotive investment in Saudi Arabia is heavily focused on digital capabilities that traditional manufacturers consider secondary:

- Advanced connected vehicle platforms

- Transportation super-apps that integrate multiple mobility services

- Blockchain-based vehicle history and maintenance systems

- Augmented reality interfaces for both drivers and maintenance technicians

Supply Chains Reimagined: Why It’s Already Too Late for Competitors

The century-old supply chain model is fundamentally broken… It’s inflexible. And it’s incapable of adapting to the speed of technological change that defines modern transportation.

Saudi Arabia knows this. And they’re building something entirely different.

Automotive investment in Saudi Arabia isn’t focused on inserting the Kingdom into existing global supply networks. Instead, they’re creating vertically integrated, highly localized production ecosystems that minimize external dependencies while maximizing innovation velocity.

“The traditional automotive supply chain was designed for stability, not transformation,” explained a supply chain architect working on the Kingdom’s automotive strategy. “We’re designing for continuous revolution.”

What does this mean in practice? It means automotive investment in Saudi Arabia prioritizes:

- Extreme vertical integration, with up to 85% of components produced within industrial clusters

- Digital twins of the entire supply network, enabling real-time optimization

- Rapid prototyping capabilities integrated directly into production facilities

- Zero distance between R&D and manufacturing operations

The implications for automotive investment in Saudi Arabia are profound. While competitors are locked into rigid, slow-moving supply networks, Saudi-based operations can iterate and improve at a pace that creates exponential advantages over time.

Autonomous Tech: The Hidden Saudi Advantage That Will Blindside Everyone

The true game-changer lies in autonomous vehicle technology – and the Kingdom is silently building an insurmountable lead.

While regulatory barriers hamstring autonomous development in most countries, automotive investment in Saudi Arabia includes purpose-built testing environments where next-generation self-driving systems evolve at unprecedented speed.

“We tested our autonomous system in California for 14 months and accumulated 20,000 miles of data,” the CTO of a leading autonomous technology company told me. “In six weeks in Saudi Arabia, we collected 40,000 miles and encountered edge cases we’d never seen before.”

Why does this matter so profoundly for automotive investment in Saudi Arabia? Because autonomous technology will determine the winners and losers of the next automotive era, and the Kingdom is creating optimal conditions for its development.

What makes this advantage even more formidable is how few people recognize it. A recent industry report evaluating global autonomous vehicle development didn’t even mention Saudi Arabia – despite the Kingdom hosting more autonomous testing miles last year than all but three other countries globally.

Why would an oil kingdom bet on electric vehicles?

This superficial thinking is why most miss the most significant investment opportunities.

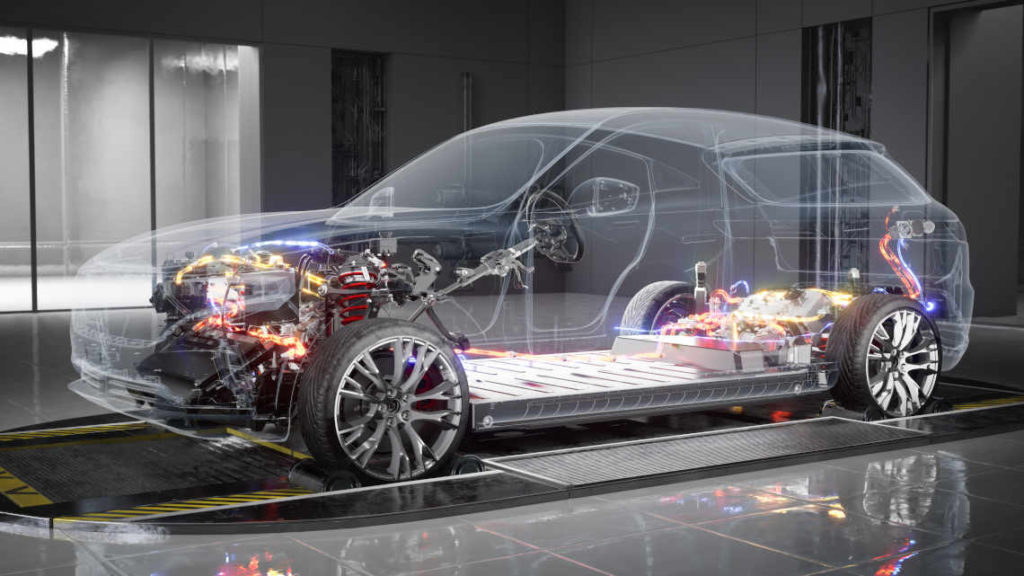

The Saudis understand something profound that eludes most Western analysts: the transition to EVs is a fundamental restructuring of the entire global transportation value chain.

This mindset shift explains why automotive investment in Saudi Arabia is heavily concentrated in high-value segments of the electric vehicle (EV) supply chain. While everyone fixates on vehicle assembly, the Kingdom has quietly secured critical positions in battery materials processing, advanced charging infrastructure, and next-generation power management systems.

They’re playing a longer game than anyone else

Saudi automotive investment strategy operates on a 50-year horizon.

This difference in time perspective creates enormous strategic advantages that compound over time. While Western automotive companies scramble to meet quarterly earnings targets, Saudi investment vehicles are architecting entire industrial ecosystems designed to dominate mid-century transportation.

The best way to understand automotive investment in Saudi Arabia isn’t through traditional automotive industry metrics. It’s through the lens of empire-building – a deliberate, patient accumulation of competitive advantages across multiple domains that, taken together, create virtually unassailable market positions.

5 Reasons Saudi Arabia Will Dominate Global Automotive by 2030

The Saudi automotive revolution is too massive to ignore, and frankly, most investors still don’t get it.

Let me break down why automotive investment in Saudi Arabia is fundamentally different from anything we’ve seen before:

- They’re playing a completely different game

While traditional automotive powers are making incremental improvements to century-old business models, Saudi Arabia is building something entirely new.

When a European parts supplier established operations in Jeddah’s industrial zone, it discovered something shocking: its Saudi facility reached productivity metrics in six months that had taken its German plant seven years to achieve. How? Purpose-built infrastructure, regulatory frameworks designed for the future rather than protecting the past, and financial incentives that make traditional government subsidies look like pocket change.

- Young, tech-obsessed consumers who never got attached to car culture 1.0

The Saudi population is digitally native in ways that reshape the entire concept of automotive consumption.

During a recent market research project on automotive investment in Saudi Arabia, I interviewed Abdullah, a 23-year-old software developer in Riyadh. “My father’s generation saw cars as status symbols,” he explained. “We see them as technology platforms. If the battery range isn’t impressive and the car can’t integrate with my digital life, I don’t care how prestigious the brand is.”

- They’re building supply chains from scratch – without legacy constraints

While traditional automotive powers struggle with retooling massive, entrenched supply networks, automotive investment in Saudi Arabia benefits from starting with a clean slate.

Most analysts miss this critical advantage. When you don’t have generations of established suppliers, union contracts, and political dependencies on specific manufacturing approaches, you can design optimal systems from day one.

Strategic Investment Areas Within the Automotive Sector

Electric Vehicle Production

Automotive investment in Saudi Arabia is increasingly focused on electric mobility solutions. The Kingdom’s Public Investment Fund (PIF) has made strategic investments in several global EV manufacturers, signaling its commitment to this technology.

Components and Parts Manufacturing

The components and parts segment offers particularly fertile ground for automotive investment in Saudi Arabia. The Kingdom’s robust industrial infrastructure and strategic location make it an ideal base for parts manufacturing and distribution throughout the Middle East and beyond.

The Saudi government has identified specific subsectors where it seeks to build competitive advantages:

- Advanced battery technology

- Lightweight materials manufacturing

- Electronic systems and sensors

- Autonomous driving technologies

Autonomous Vehicle Technology

The future of automotive investment in Saudi Arabia increasingly points toward autonomous driving technology. The Kingdom’s modern infrastructure, wide roads, and progressive regulatory approach provide an ideal testing ground for self-driving vehicles.

You’d be amazed at how quickly Saudi Arabia has adapted its regulatory framework to accommodate autonomous vehicle testing.

NEOM, Saudi Arabia’s futuristic city project, plans to be built around autonomous transportation systems from the ground up. This creates unique opportunities for automotive investment in Saudi Arabia focused on developing technologies specifically designed for this urban laboratory.

研究與開發

Perhaps the most forward-looking area of automotive investment in Saudi Arabia centers on research and innovation. The Kingdom has established several technology parks and innovation centers dedicated to automotive technology development.

King Abdullah University of Science and Technology (KAUST) has formed partnerships with major automotive manufacturers to develop next-generation technologies, focusing particularly on sustainable mobility solutions adapted to the region’s unique climate conditions.

Navigating Challenges in the Saudi Automotive Sector

Despite the abundant opportunities, automotive investment in Saudi Arabia comes with its own set of challenges. Understanding these potential hurdles is crucial for developing effective entry and expansion strategies.

監管環境

The regulatory landscape for automotive investment in Saudi Arabia continues to evolve. While significant progress has been made in streamlining business processes, investors should work with experienced partners who understand the nuances of local regulations.

Talent Development

Building a skilled workforce represents another challenge for automotive investment in Saudi Arabia. The sector requires specialized technical skills that are currently being developed within the local workforce.

Key Success Factors for Automotive Investors in Saudi Arabia

策略夥伴關係

Successful automotive investment in Saudi Arabia often hinges on forming the right partnerships. Joint ventures with local entities can provide valuable market insights, facilitate regulatory compliance, and accelerate market entry.

Long-term Vision

The most successful automotive investments in Saudi Arabia share a common characteristic: a long-term strategic vision. The Kingdom’s automotive sector is still developing, and companies willing to invest in market development often reap substantial rewards.

Localization Strategy

Developing a thoughtful localization strategy is essential for automotive investment in Saudi Arabia. This goes beyond merely setting up manufacturing facilities—it involves adapting products to local preferences and building genuine connections with Saudi consumers.

Sustainability and Circular Economy

The Kingdom has set ambitious targets for reducing carbon emissions in manufacturing, with the automotive sector designated as a showcase for these efforts. Green manufacturing facilities that incorporate renewable energy, water recycling systems, and zero-waste principles receive preferential treatment in government incentive programs.

The circular economy approach extends throughout the automotive lifecycle:

- Remanufacturing of components and parts

- Advanced recycling of end-of-life vehicles

- Sustainable material sourcing

- Carbon-neutral logistics operations

Summary: Key Insights on Automotive Investment in Saudi Arabia

✅ Saudi Arabia’s Vision 2030 has created unprecedented opportunities for automotive investment across the entire value chain

✅ The Kingdom offers attractive incentives including tax holidays, customs exemptions, and subsidized industrial infrastructure

✅ The domestic market features high purchasing power, rapid vehicle replacement cycles, and growing demand for premium and electric vehicles

✅ Strategic investment areas include EV production, components manufacturing, autonomous vehicle technology, and automotive R&D

✅ The digital transformation of the automotive value chain and sustainability initiatives create additional opportunities

✅ Key success factors include forming strategic partnerships, maintaining a long-term vision, developing effective localization strategies, and understanding cultural nuances

✅ Challenges exist in navigating regulations, developing specialized talent, and building local supply chains

What Makes SIS International a Top Automotive Market Research Partner in Saudi Arabia?

Most market research firms are playing the same tired game – recycling secondhand insights while pretending to offer original analysis. SIS國際 operates differently, especially when it comes to automotive investment in Saudi Arabia.

- CUSTOMIZED APPROACH: While most firms apply cookie-cutter methodologies across markets, SIS builds research frameworks specifically calibrated to Saudi Arabia’s unique automotive ecosystem.

- THE 40+ YEARS OF EXPERIENCE: Four decades of market research creates pattern recognition that can’t be faked. SIS consultants interpret it through a lens of historical context, revealing which trends are truly transformative versus temporary market noise.

- THE GLOBAL DATABASES FOR THE RECRUITMENT: SIS maintains the most comprehensive consumer and industry databases specific to Saudi Arabia’s automotive sector.

- PROJECTS GET DONE FAST: SIS research teams operate at a pace that matches the Kingdom’s accelerated development timeline, delivering actionable insights when they still represent competitive advantages rather than common knowledge.

- AFFORDABLE RESEARCH: SIS has developed streamlined research methodologies that deliver enterprise-grade insights without enterprise-level pricing.

- REGIONAL EXPERTISE: Their Saudi-specific research teams include cultural natives who understand the subtle contextual factors that often determine success or failure in the Kingdom.

- COMPREHENSIVE METHODOLOGY: SIS integrates quantitative and qualitative approaches into unified research frameworks that capture both measurable market metrics and the deeper psychological drivers behind consumer behavior in Saudi Arabia’s unique cultural context.

Frequently Asked Questions About Automotive Investment in Saudi Arabia

What specific incentives does Saudi Arabia offer for automotive investors?

What makes Saudi incentives transformative is their comprehensive nature. Beyond financial benefits, the government provides turnkey infrastructure specifically designed for automotive operations, expedited regulatory approvals through dedicated investment channels, and preferential access to long-term energy contracts that guarantee operational stability.

How large is the domestic automotive market in Saudi Arabia?

Saudi Arabia represents the region’s largest automotive market by a substantial margin. What makes this market especially valuable isn’t just its size but its composition.

The premium segment accounts for roughly 15% of overall sales – nearly triple the global average – while SUV penetration exceeds 60%, creating concentrated demand in high-margin vehicle categories.

What are the main challenges for automotive manufacturing in Saudi Arabia?

The core challenge is talent development at scale. The Kingdom is addressing this systematically through specialized training programs in partnership with global educational institutions, targeted scholarship initiatives for automotive engineering disciplines, and incentives for manufacturers who establish robust knowledge transfer mechanisms.

What types of automotive components show the most promise for manufacturing in Saudi Arabia?

Saudi Arabia is strategically targeting components related to the software-defined vehicle revolution – advanced power electronics, sensor systems, battery technologies, and digital experience platforms.

The Kingdom’s existing petrochemical expertise creates natural advantages in specialized materials development, particularly advanced polymer composites that reduce vehicle weight while enhancing performance characteristics.

How does Saudi Arabia’s location affect automotive export potential?

Saudi Arabia’s geographical position creates logistical advantages that most analysts systematically undervalue.

The Kingdom sits at the intersection of major global shipping lanes with direct access to European, Asian, and African markets. This strategic location reduces shipping times to major regional markets by up to 40% compared to other manufacturing locations.

What role does technology transfer play in Saudi Arabia’s automotive strategy?

The Kingdom has systematically structured its automotive investment initiatives to maximize knowledge transfer through innovative partnership models. Rather than focusing solely on finished vehicle production, Saudi Arabia prioritizes collaborations that build domestic technological capabilities.

This approach includes specialized automotive engineering programs developed in partnership with global universities, innovation centers co-managed with leading automotive technology companies, and manufacturing operations structured as genuine knowledge transfer vehicles rather than simple production facilities.

我們在紐約的工廠位置

11 E 22nd Street, Floor 2, 紐約, NY 10010 電話:+1(212) 505-6805

關於 SIS 國際

SIS國際 提供定量、定性和策略研究。我們為決策提供數據、工具、策略、報告和見解。我們也進行訪談、調查、焦點小組和其他市場研究方法和途徑。 聯絡我們 為您的下一個市場研究項目。