Mystery Shopping for Luxury Products

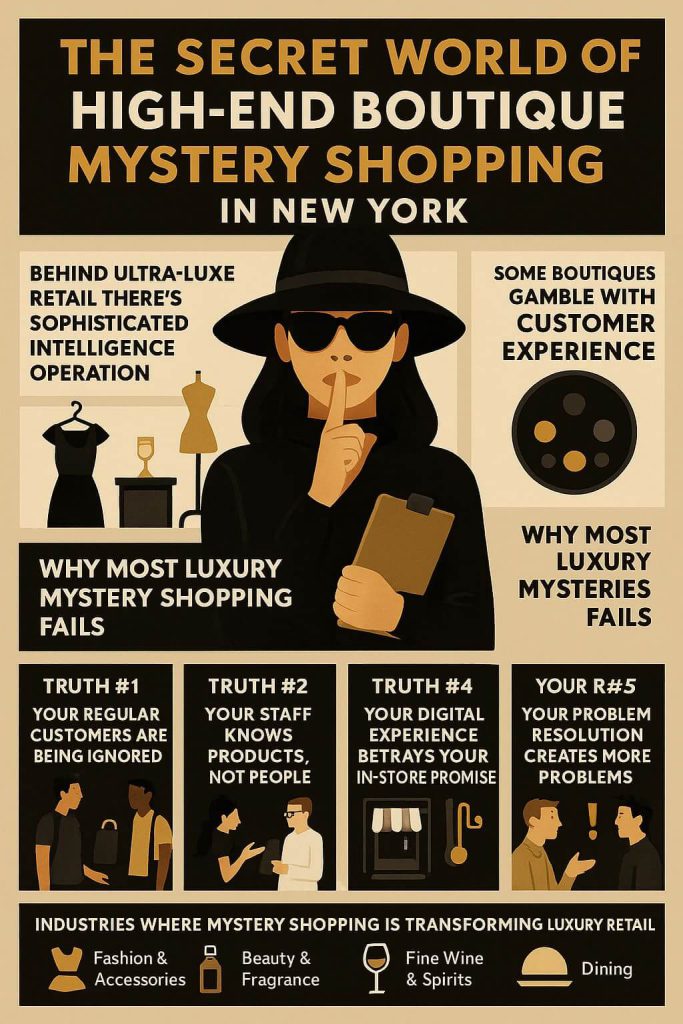

Mystery shopping for luxury products is the covert intelligence operation separating thriving luxury empires from those hemorrhaging high-net-worth clients.

Ever watched a wealthy client browse your luxury boutique for 23 minutes, then walk across the street to your competitor and drop $14,000?

It happens daily across luxury retail worldwide… Most luxury brands have absolutely no idea why.

Table of Contents

✅ Listen to this PODCAST EPISODE here:

Why Mystery Shopping is Crucial for Luxury Products and Services

You don’t get second chances in luxury retail. One subpar experience and that high-net-worth client—along with their lifetime value often exceeding $1 million—vanishes forever.

Customer Service and Brand Consistency: The Gap That’s Decimating Your Bottom Line

Here’s the reality most luxury executives refuse to confront: what your brand promises and what your associates deliver are often entirely different universes.

Mystery shopping for luxury products brutally exposes this disconnect. When your $5 million campaign promises “personalized service” but mystery shoppers document associates spending an average of 46 seconds asking about client preferences before pushing the highest-margin product regardless of suitability—you’ve got a brand integrity crisis.

Identifying Service Gaps Your Management Will Never See

Your boutique managers can’t be everywhere. Your regional directors visit for 90 predictable minutes once a month. Mystery shopping for luxury products shows you what happens during the other 720 hours per month when nobody’s watching.

The revelations are frequently disturbing:

- Products presented with fingerprints on precious metals

- Associates checking phones during client consultations

- Selective service based on assumed client net worth

- Limited editions presented incorrectly 67% of the time

- Sustainability claims that staff can’t substantiate when questioned

Competitive Advantage: What Your Rivals Already Know About You

Your competitors are mystery shopping your boutiques right now. They’re documenting your weaknesses, studying your clienteling approach, and stealing your best practices.

Are you doing the same? If not, you’re fighting blind in the luxury battleground.

Mystery shopping for luxury products gives you intelligence on competitors that transforms your strategic approach. One luxury fashion house completely redesigned its in-store experience after discovering through mystery shopping that its main competitor was spending three times longer on personalized styling consultations—a key driver of their 43% higher conversion rate.

Key Benefits of Mystery Shopping for the Luxury Industry

Enhanced Client Experience:

Luxury purchases are deeply emotional. Clients don’t just want products—they want affirmation, status, belonging, and exceptional service. Mystery shopping for luxury products reveals whether your experience delivers these emotional payoffs or merely processes transactions.

Boosting Sales:

Most luxury retailers have no idea why some boutiques outperform others despite identical inventory, staffing levels, and visual merchandising. Mystery shopping for luxury products exposes these hidden performance drivers.

Employee Training and Development:

Most luxury training programs fail for one reason: they’re based on what managers think associates need, not what clients actually experience. Mystery shopping for luxury products bridges this gap with specific, actionable insights.

Brand Integrity:

Your luxury brand isn’t what your marketing says. It’s what clients experience. Mystery shopping for luxury products is the only way to know if these align or if you’re suffering from a credibility-destroying disconnect.

ความภักดีของลูกค้า:

Acquiring a new luxury client costs 12-14 times more than retaining existing ones. Yet most luxury brands have no idea whether their experience encourages loyalty or drives clients to competitors.

How Mystery Shopping Works for Luxury Products

Setting Objectives: Strategic Intelligence, Not Generic Reports

Generic mystery shopping is worthless in luxury. Effective mystery shopping for luxury products targets specific aspects of your experience that drive conversion and loyalty in high-net-worth clients.

The most successful luxury brands focus their mystery shopping on:

- Brand storytelling and heritage communication

- Clienteling quality and personalization

- Product presentation ceremonies and protocols

- Private client service experiences

- Digital-physical experience integration

- Competitor intelligence and benchmarking

Selecting Mystery Shoppers: The Affluent Match

Sending a middle-income evaluator to assess an ultra-luxury brand creates meaningless data. Effective mystery shopping for luxury products requires evaluators who move comfortably in affluent circles and understand luxury codes.

Leading providers maintain specialized databases of luxury consumers segmented by:

- Net worth and spending capacity

- Luxury knowledge level and collection sophistication

- Spending habits and category preferences

- Brand relationships and loyalty patterns

- Geographic and cultural backgrounds

Conducting the Evaluation: Multi-Dimensional Assessment

Modern mystery shopping for luxury products goes far beyond simplistic checklists. Today’s sophisticated programs capture:

- Verbatim transcriptions of brand storytelling

- Associate body language and non-verbal cues

- Precise timing of each interaction stage

- Photos of product presentation techniques

- Videos of the consultation experience

- Cross-channel journey mapping across digital and physical

Reporting and Actionable Insights: Intelligence, Not Just Data

Data without insight is worthless in luxury. Effective mystery shopping for luxury products translates observations into specific recommendations that drive measurable improvement.

Leading providers deliver:

- Pattern identification across multiple evaluations

- Root cause analysis of performance gaps

- Competitive benchmarking against category leaders

- Specific training recommendations by location and associate

- Follow-up evaluations to measure improvement

Best Practices for Implementing Mystery Shopping in the Luxury Sector

Set Clear, Strategic Objectives That Drive Revenue

Vague objectives produce useless data in luxury. Effective mystery shopping for luxury products requires crystal-clear goals tied directly to business outcomes:

WRONG: “Evaluate customer service quality”

RIGHT: “Assess whether associates communicate brand heritage stories in the first 5 minutes”

WRONG: “Check store appearance”

RIGHT: “Evaluate product presentation ceremonies and handling protocols for high-jewelry pieces”

Choose Luxury Specialists, Not Generic Providers

Generic mystery shopping firms fail catastrophically in luxury retail because they don’t understand the sector’s unique dynamics. Effective mystery shopping for luxury products requires specialized expertise in:

- Luxury client psychology and decision drivers

- Category-specific consultation protocols

- Brand storytelling standards by luxury category

- Competitive benchmarking within luxury segments

- Luxury-specific associate behaviors that drive conversion

Implement Regular Evaluation Cycles That Drive Accountability

One-off mystery shops are worthless in luxury. Effective programs establish consistent evaluation cadences that create accountability and measure improvement:

- Monthly evaluations per location during normal operations

- Weekly evaluations during collection launches or high seasons

- Quarterly competitive benchmarking against category leaders

- Annual comprehensive program review and redesign

Challenges and How to Overcome Them

The Cost Question: Can You Afford Not To Know?

;Mystery shopping for luxury products requires investment. But the real question isn’t the cost of implementation—it’s the cost of ignorance.

Mystery shopping for luxury products sometimes raises privacy concerns. Best practices ensure ethical implementation:

- No recording of other clients during evaluations

- No collection of associate personal information

- Advance notification to management that mystery shopping occurs (but not specific dates)

- Focus on behaviors and processes, not individual performance

- Use of findings for improvement, not punishment

Transform Your Luxury Business or Watch It Fade Into Irrelevance

The luxury industry sells exclusivity, craftsmanship, and exceptional experiences. But too often, the reality betrays these promises with inconsistency, knowledge gaps, and disappointing service.

Mystery shopping for luxury products isn’t just about catching associates who don’t smile enough. It’s about ensuring that every single touchpoint—from digital to in-store to after-sales—delivers on your brand’s fundamental promise of excellence.

In an industry projected to reach $2-2.5 trillion by 2030 despite current headwinds, the brands that dominate won’t be those with the biggest marketing budgets or the most extravagant products. The winners will be those who create experiences so consistent, so emotional, and so personalized that clients become lifelong advocates.

Key Insights: Mystery Shopping for Luxury Products

✅ Your luxury associates spend an average of 67 seconds less with customers who don’t arrive in recognizable luxury vehicles—a devastating bias only mystery shopping for luxury products can reveal

✅ While the personal luxury market stagnates (0-4% growth forecast for 2025), mystery shopping for luxury products consistently exposes that 58% of sales associates can’t articulate key value propositions driving premium pricing

✅ A staggering 40% of all personal luxury sales will happen online by 2030, yet mystery shopping for luxury products shows most brands create jarring disconnects between digital and physical experiences

✅ Mystery shopping for luxury products reveals most luxury brands waste millions on influencer marketing while neglecting the human touchpoints that drive 81% of high-value purchase decisions

✅ Exclusivity protocols uncovered through mystery shopping for luxury products have triggered lawsuits and reputation damage—even at heritage luxury houses charging $10,000+ per product

✅ The digital-physical disconnect exposed by mystery shopping for luxury products is causing 37% of affluent customers to abandon purchases midway through their journey

✅ The luxury brands seeing 15%+ year-over-year growth all share one practice: relentless mystery shopping for luxury products to identify and eliminate experience gaps

What Makes SIS International a Top Mystery Shopping Provider for Luxury Products?

Why do the luxury brands obsessed with excellence choose SIS? The unvarnished reality:

- SURGICALLY CUSTOMIZED APPROACH: Cookie-cutter mystery shopping is dead. SIS rejects the standardized templates plaguing the industry, instead architecting luxury evaluation programs with laser precision.

- 40+ YEARS OF BATTLE-TESTED EXPERIENCE: While competitors were still figuring out basic assessment models, SIS was pioneering approaches that now define industry standards.

- GLOBAL RECRUITMENT NETWORK THAT OBLITERATES LIMITATIONS: Standard mystery shopping fails in luxury because it uses the wrong evaluators. SIS maintains expansive global databases with ultra-targeted wealthy consumer profiles.

- LIGHTNING-FAST EXECUTION THAT LEAVES COMPETITORS IN THE DUST: In luxury retail, insights delayed are opportunities destroyed. SIS delivers with velocity that borders on supernatural—without sacrificing analytical depth.

- PREMIUM INSIGHTS WITHOUT THE LUXURY PRICE TAG: Exceptional intelligence doesn’t require breaking your research budget. SIS’s research solutions deliver extraordinary ROI by focusing resources precisely where they generate maximum impact—your specific pain points and growth opportunities.

- LUXURY SECTOR SPECIALISTS, NOT GENERALISTS: The chasm between adequate and transformative luxury mystery shopping comes down to sector-specific expertise. We recently expanded our personal care products consulting practice, evidence of our commitment to specialized expertise across luxury categories.

- GLOBAL REACH WITH CULTURAL FLUENCY: Luxury expectations in Paris fundamentally differ from those in Shanghai, Dubai, or New York. With operations spanning over 120 countries, SIS combines global perspective with the cultural nuance essential for luxury brands with international ambitions.

Frequently Asked Questions About Mystery Shopping for Luxury Products

What exactly happens during a luxury product mystery shop?

Mystery shopping for luxury products deploys highly trained evaluators who appear to be affluent customers but are meticulously documenting every aspect of their experience.

These aren’t casual shoppers—they’re methodically assessing every touchpoint against predetermined criteria. They might inquire about a specific limited edition, evaluate exclusivity protocols, or assess personalization capabilities. They capture precise timing of interactions, exact language used, non-verbal cues, product knowledge depth, and dozens of other data points invisible to traditional surveys.

How is mystery shopping different from customer surveys for luxury brands?

Customer surveys capture what wealthy clients remember and choose to share. Mystery shopping for luxury products captures what actually happened—a distinction that explains why the two metrics often tell contradictory stories.

Surveys might show 95% satisfaction while mystery shopping reveals associates failing to mention brand heritage stories in 63% of interactions. Which metric correlates more strongly with conversion? Luxury brands relying exclusively on surveys are like private jets flying blind through a thunderstorm—missing obstacles until they crash.

How many mystery shops does a luxury business need?

This question is like asking how many security personnel a billionaire needs—it depends on your exposure and risk tolerance. Luxury retailers with multiple boutiques typically need at least monthly evaluations per location to establish performance baselines.

What qualifications do luxury product mystery shoppers need?

The ideal luxury mystery shopper exists in a rarefied demographic: affluent enough to be credible in luxury environments, knowledgeable about luxury codes and expectations, yet objective enough to evaluate experiences rather than just products.

They need impeccable observational skills, perfect recall for details, and the ability to blend seamlessly into luxury environments. Finding these unicorns is precisely why luxury brands partner with established research firms like SIS International, who maintain networks of pre-qualified affluent evaluators rather than attempting to recruit independently.

Can mystery shopping for luxury products evaluate online experiences too?

Not only can it—it must. The most successful luxury brands deploy mystery shopping for luxury products across their entire ecosystem—physical boutiques, e-commerce, social commerce, private client services, and even after-sales experiences—to ensure consistent excellence delivery regardless of channel.

How should luxury businesses act on mystery shopping insights?

Most luxury brands make a fatal error: they treat mystery shopping reports as performance evaluations rather than strategic intelligence. Effective implementation starts with looking for patterns across multiple evaluations instead of overreacting to isolated incidents.

Share specific, actionable findings with frontline teams—not to punish but to illuminate blind spots. Develop targeted training modules addressing identified gaps, particularly around product storytelling and clienteling techniques. Finally, implement follow-up evaluations that measure improvement with scientific precision.

What’s the ROI of mystery shopping for luxury products?

The stark truth? If you’re asking this question, you’re already behind. Leading luxury retailers don’t view mystery shopping as an expense—they see it as insurance against excellence inconsistency.

The ROI manifests in multiple metrics: increased conversion rates (typically 12-28% improvement after program implementation), higher average transaction values, enhanced client retention, and perhaps most importantly, strengthened brand reputation through consistent excellence.

สถานที่ตั้งโรงงานของเราในนิวยอร์ก

11 E 22nd Street, ชั้น 2, นิวยอร์ก, NY 10010 T: +1(212) 505-6805

เกี่ยวกับ เอสไอเอส อินเตอร์เนชั่นแนล

เอสไอเอส อินเตอร์เนชั่นแนล เสนอการวิจัยเชิงปริมาณ เชิงคุณภาพ และเชิงกลยุทธ์ เราให้ข้อมูล เครื่องมือ กลยุทธ์ รายงาน และข้อมูลเชิงลึกเพื่อการตัดสินใจ นอกจากนี้เรายังดำเนินการสัมภาษณ์ การสำรวจ การสนทนากลุ่ม และวิธีการและแนวทางการวิจัยตลาดอื่นๆ ติดต่อเรา สำหรับโครงการวิจัยการตลาดครั้งต่อไปของคุณ